Introduction

6 Smart Investments Every Boomer Needs for a Secure Solo Retirement

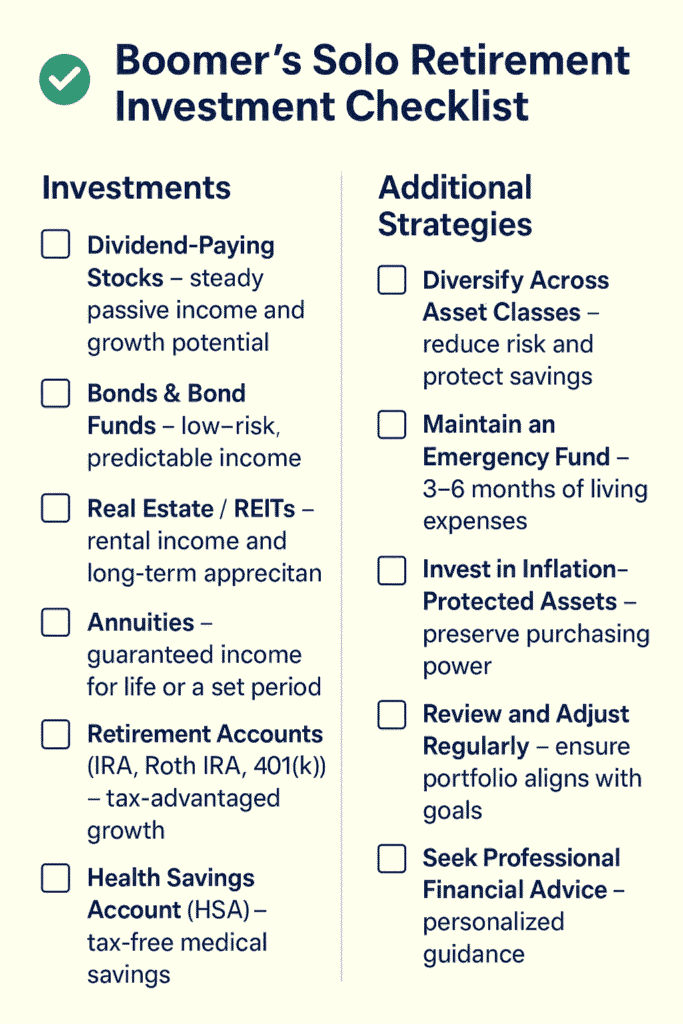

Planning for retirement can feel overwhelming, especially for boomers preparing to retire on their own. With Social Security, pensions, and savings forming just part of the picture, making smart investment decisions is crucial to ensure financial security and peace of mind. The good news? There are several proven investment strategies that can help boomers build a reliable income stream, preserve wealth, and enjoy their golden years without worry. In this article, we’ll explore six smart investments every boomer needs for a secure solo retirement, providing insights tailored to those who want independence and financial freedom.

Check Our Investment Related Posts!

Table of Contents

1. Dividend-Paying Stocks

Dividend-paying stocks offer boomers a way to generate steady, passive income while benefiting from potential market growth. Companies with a strong history of paying dividends tend to be financially stable, providing reliable cash flow for retirees.

Why It’s Smart for Boomers:

- Provides regular income to supplement Social Security

- Offers potential for long-term capital growth

- Can help hedge against inflation when companies increase dividends over time

Tips:

- Focus on blue-chip companies with consistent dividend history

- Consider dividend-focused ETFs for diversification and lower risk

2. Bonds and Bond Funds

Bonds are a low-risk investment option that can provide predictable income for boomers. Government and corporate bonds can act as a buffer against market volatility, giving retirees peace of mind.

Why It’s Smart for Boomers:

- Lower risk compared to stocks

- Predictable interest payments for budgeting

- Preserves capital while generating income

Tips:

- Diversify between Treasury bonds, municipal bonds, and corporate bonds

- Ladder bonds with varying maturities to ensure steady cash flow

Check Best American Express Credit Cards

3. Real Estate Investment

Investing in real estate can offer both income and wealth appreciation, making it an attractive option for boomers looking to retire independently. Whether through rental properties or Real Estate Investment Trusts (REITs), real estate provides a tangible asset that can generate steady returns.

Why It’s Smart for Boomers:

- Potential for monthly rental income

- Long-term appreciation of property value

- REITs offer exposure to real estate without the hassle of property management

Tips:

- Start with single-family rentals or REITs for lower entry costs

- Consider location, demand, and property management options carefully

4. Annuities

Annuities are insurance products designed to provide guaranteed income for life or a fixed period, which can be incredibly appealing for boomers who want stability in retirement.

Why It’s Smart for Boomers:

- Offers predictable income regardless of market fluctuations

- Can be tailored to provide income for life or a set number of years

- Helps prevent outliving your savings

Tips:

- Research fixed vs. variable annuities to understand risk and payout

- Factor in fees and surrender charges before committing

Check This Latest Post Social Security Payments

5. Retirement Accounts (IRA, Roth IRA, 401(k))

Maximizing contributions to retirement accounts is a critical step for boomers seeking financial independence. These accounts offer tax advantages that can boost retirement savings significantly over time.

Why It’s Smart for Boomers:

- Tax-deferred growth in traditional IRAs and 401(k)s

- Tax-free withdrawals in Roth IRAs if rules are followed

- Helps build a substantial nest egg before retirement

Tips:

- Catch-up contributions are allowed for those over 50

- Diversify investments within your accounts (stocks, bonds, ETFs)

6. Health Savings Accounts (HSA)

Healthcare costs can be one of the biggest financial burdens during retirement. An HSA allows boomers to save tax-free for medical expenses, making it a smart addition to a retirement plan.

Why It’s Smart for Boomers:

- Contributions are tax-deductible

- Funds grow tax-free

- Withdrawals for qualified medical expenses are tax-free

Tips:

- Contribute the maximum allowed each year

- Invest HSA funds for long-term growth if your account allows

Conclusion

Planning a secure solo retirement requires strategic investments that provide income, growth, and peace of mind. By combining dividend-paying stocks, bonds, real estate, annuities, retirement accounts, and health savings accounts, boomers can build a diversified portfolio that supports independence and financial stability. The key is to start early, diversify wisely, and continually review your investment strategy to ensure it aligns with your retirement goals.

Investing wisely today can mean stress-free, financially secure golden years tomorrow. Boomers who take control of their retirement planning will enjoy the freedom and independence they deserve.

More Investment Related Content

Additional Strategies for Boomers to Secure Their Solo Retirement

While the six investments we covered form the backbone of a strong retirement plan, there are extra strategies and tips that can further enhance financial security and peace of mind:

1. Diversify Across Asset Classes

Diversification is key to reducing risk and protecting your savings. Instead of putting all your money in one investment type, spread it across stocks, bonds, real estate, and other instruments. This ensures that a downturn in one market doesn’t severely impact your retirement funds.

2. Keep an Emergency Fund

Even in retirement, it’s essential to have 3–6 months of living expenses in cash or a high-yield savings account. This fund covers unexpected expenses such as home repairs, medical bills, or short-term market downturns without having to liquidate investments at a loss.

3. Consider Inflation-Protected Investments

Inflation can erode your purchasing power over time. Boomers should consider investments such as Treasury Inflation-Protected Securities (TIPS) or dividend stocks that historically increase payouts with inflation to preserve wealth.

4. Review and Adjust Regularly

Retirement planning isn’t a “set it and forget it” process. Boomers should review their portfolio at least annually to ensure it aligns with goals, risk tolerance, and lifestyle changes. Adjusting asset allocation can help maintain a balance between growth and safety.

5. Seek Professional Advice

A certified financial planner can help boomers navigate complex investment choices, tax implications, and long-term care considerations. Personalized guidance ensures your retirement plan is realistic, diversified, and tailored to your solo lifestyle.

Other Helpful Sources For You!

- T. Rowe Price – Retiring Baby Boomers: Six Steps for Smart Planning

- Investopedia – Safest Investments for a Boomer’s Portfolio

- Springwater Wealth – Everything Baby Boomers Need to Know for a Secure Retirement

- Investopedia – What No One Tells You About Retiring Alone

- Yahoo Finance – 6 Key Investments for Boomers Planning to Retire on Their Own

Harsh Muchhal is a Software Engineer and Financial Analyst passionate about helping people understand the world of finance and technology in simple, practical ways. With experience in both software development and financial analysis, he blends technical knowledge with real-life money insights to make complex topics easy for everyone. Harsh shares valuable guides, tips, and updates on personal finance, investing, credit cards, and the latest tech innovations — helping readers make smarter choices in today’s fast-changing digital world.

Pingback: Social Security COLA 2026: How the 2.8% Increase Impacts Your Monthly Benefits - MY FINTECH INSIGHT

Pingback: Car Loan vs. Leasing in the U.S.: Which Option Saves You More in 2025? - MY FINTECH INSIGHT

Pingback: White House Freezes $26 Billion in Democratic States Amid 2025 Shutdown Standoff

Pingback: 10 Best Ways to Save Money Fast in 2025 and Beyond - MY FINTECH INSIGHT