Introduction

Boeing Co. (NYSE: BA) is one of the most recognized names in aerospace and defense. In 2025, Boeing stock remains in the spotlight as the company navigates regulatory challenges, large aircraft orders, and financial recovery efforts. For investors, Boeing stock is both an opportunity and a risk, depending on how the company executes its long-term strategy.

“Just like financial products such as Best American Express Credit Cards in the USA 2025, Boeing stock is a major topic for U.S. investors.”

Boeing Stock Performance in 2025

The performance of Boeing stock this year has been shaped by a mix of regulatory updates, global airline demand, and geopolitical factors. Recently, the Federal Aviation Administration (FAA) eased certain restrictions, allowing Boeing to resume more control over airworthiness certificates for its 737 MAX and 787 aircraft. This positive step supported Boeing stock prices, which climbed following the announcement.

On the commercial side, Turkish Airlines placed an order for 225 aircraft, including 75 Dreamliners and 150 737 MAX jets. Such deals provide a boost to revenue expectations and demonstrate market confidence in Boeing’s future.

Still, Boeing stock faces short-term pressure due to delays in the 777X program and concerns about free cash flow. Some analysts warn that further charges may reduce profitability, while others view these as necessary “clearing events” that could stabilize Boeing’s long-term outlook.

“For investors comparing equities with other financial strategies, you may also want to explore our guide on Top 5 Best Credit Cards in the U.S..”

Why Boeing Stock Matters for Investors

Investors track Boeing stock closely because of the company’s unique market position. Boeing operates across multiple segments, including:

- Commercial Airplanes – 737 MAX, 787 Dreamliner, 777X

- Defense, Space & Security – fighter jets, rotorcraft, and space systems

- Global Services – supply chain, maintenance, and training solutions

This diversified model allows Boeing stock to benefit not only from global travel recovery but also from defense contracts and space exploration.

Boeing Stock: Opportunities Ahead

- Rising Global Air Travel – With international travel rebounding, airlines are expanding their fleets. Boeing stands to benefit from these aircraft purchases.

- Strategic Partnerships – Boeing’s defense unit has partnered with Palantir for AI adoption, signaling innovation in defense and space solutions.

- FAA Easing Oversight – Regulatory progress boosts investor confidence in Boeing’s ability to deliver aircraft on schedule.

- Geopolitical Wins – Deliveries to Chinese airlines suggest improving trade relations, which can support Boeing stock momentum.

Risks Impacting Boeing Stock

- 777X Delays – Any additional program delays could hurt cash flow and lead to higher costs.

- Debt & Liquidity Pressure – Boeing carries significant debt from the pandemic period, putting pressure on future earnings.

- Safety & Regulation – Even with FAA progress, oversight remains strict. Any future quality or safety issues would weigh heavily on Boeing stock.

- Market Competition – Airbus continues to challenge Boeing with strong aircraft demand globally.

“High debt pressures remind us why risk management is as important in equities as in personal finance tools like managing credit wisely.”

Analyst Views on Boeing Stock

Market analysts remain divided:

- Bullish Case – Some analysts believe Boeing stock could see upside if the company executes deliveries, maintains free cash flow, and secures defense orders.

- Bearish Case – Others warn of up to 30% downside risk if debt and 777X delays weigh on investor sentiment.

For long-term investors, Boeing stock represents a recovery play, while short-term traders may experience volatility.

Boeing Stock in Numbers (2025 Snapshot)

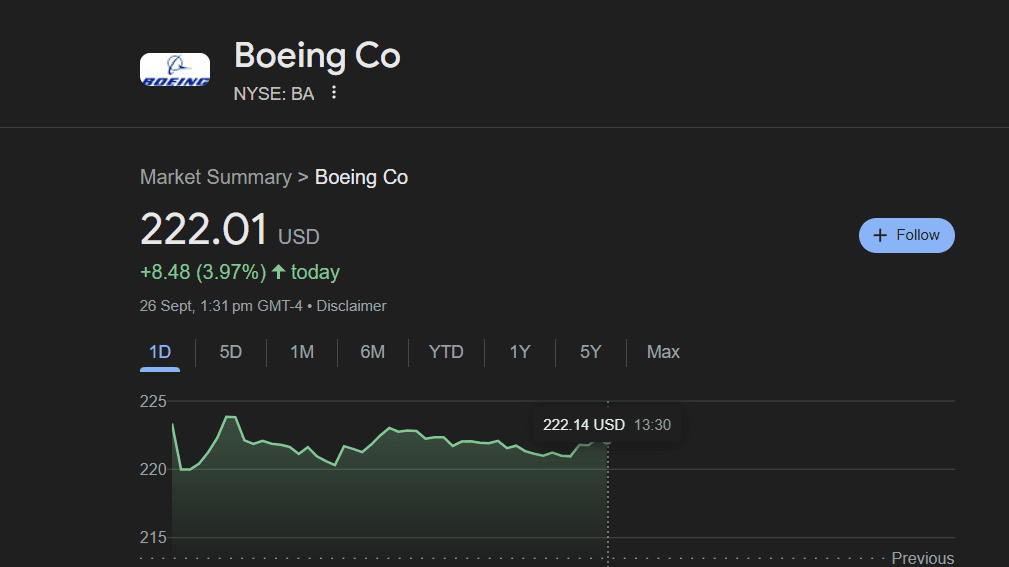

- Current Price: ~$222 (as of September 26, 2025)

- Market Cap: Over $130 billion

- Recent High/Low: $224 / $214

- Sector: Aerospace & Defense

(Source: Market data, September 2025)

Conclusion

In 2025, Boeing stock is at a crossroads. Major aircraft orders and regulatory relief provide optimism, but risks tied to debt, program delays, and market competition remain. For investors, Boeing stock is best approached with a balanced strategy: recognizing the long-term growth potential while being mindful of short-term challenges.

Whether you are a long-term investor seeking exposure to aerospace or a trader looking at short-term price action, Boeing stock deserves a place on your watchlist.

Whether you’re exploring equities like Boeing stock or financial tools such as American Express Credit Cards, smart decisions start with research.”

FAQs

Q1: Is Boeing stock a good investment in 2025?

Boeing stock offers long-term potential due to large aircraft orders and easing FAA oversight, but it carries risks like debt and 777X delays.

Q2: What are the main risks for Boeing stock investors?

Key risks include high debt, regulatory challenges, competition from Airbus, and delays in major aircraft programs like the 777X.

Q3: How is Boeing performing financially in 2025?

Boeing’s market cap exceeds $130 billion, and its stock trades near $222 as of September 2025, supported by new aircraft orders and defense contracts.

Q4: What could boost Boeing stock performance?

Factors such as improved deliveries, stable free cash flow, and strong global airline demand could lift Boeing stock prices.

Q5: Should investors hold Boeing stock long-term?

Yes, long-term investors may benefit from Boeing’s recovery and global aviation growth, though patience is required amid ongoing challenges.

Boeing Co : Stock 26 sept

- National Finance Commission in the USA – Meaning, Functions, and Importance

- Credit Card With Knife — Is It Legal & Where to Buy (2026 Buyer’s Guide)

- How Much Monthly Income Do You Need for a Credit Card in the USA 2026?

- How Difficult Is It to Get a Small Business Loan?

- What Is the Main Purpose of Meta in 2026? Company Vision, Goals & Future

Harsh Muchhal is a Software Engineer and Financial Analyst passionate about helping people understand the world of finance and technology in simple, practical ways. With experience in both software development and financial analysis, he blends technical knowledge with real-life money insights to make complex topics easy for everyone. Harsh shares valuable guides, tips, and updates on personal finance, investing, credit cards, and the latest tech innovations — helping readers make smarter choices in today’s fast-changing digital world.

Pingback: Nike Stock Soars on Earnings Beat 2025: Can the Turnaround Last?